FTSE 1oo Support 6862 6846 6825 6749 6739

FTSE 100 Resistance 6902 6908 6918 6925 6956

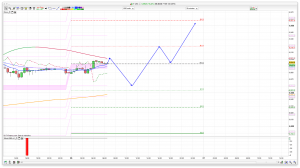

Good morning. Well we dropped from the 6925 area first thing yesterday down to tag the long order at 6868 which had a bit of a bounce but with the US closed for Labor Day it was all fairly quiet after that initial move. Asia has rallied to a one year high, and focus is still on the unlikely chance of rate rises this month. The FTSE bulls managed to hold onto Fridays gains pretty well, and once again the rhetoric is all about 7000, and possibly higher. The 2 hour chart is still bullish, with support at 6862 today, while the bulls will need to break the top of the Bianca channels around the 6915 area.

US & Asia Overnight from Bloomberg

Asian stocks rose to a one-year high and the dollar maintained losses from the last session as prospects for a U.S. interest-rate increase this month remained subdued. Australia’s dollar held gains after a central bank policy meeting and oil maintained Monday’s advance.

Technology shares were the best performers on the MSCI Asia Pacific Index, while U.S. equity index futures edged higher. The Bloomberg Dollar Spot Index held near a one-week low as the Aussie advanced for a fifth day, its longest winning streak in six months. Crude traded above $45 a barrel after the world’s top two producers pledged to cooperate to stabilize global markets. Japan’s 30-year bonds snapped a nine-day losing streak as demand firmed at an auction of the notes.

Global equities and emerging-market assets have gained ground since American payrolls data on Friday helped damp the likelihood of a U.S. interest-rate increase this month. While the Federal Reserve is pondering tightening monetary policy, its counterparts across much of Asia and Europe are in the midst of easing cycles and a U.S. hike has the potential to destabilize financial markets. The Reserve Bank of Australia left its benchmark rate at a record low on Tuesday, after cutting borrowing costs in August.

“Monetary policy is going to remain easy around the world and that will continue to be supportive of risk assets,” said James Woods, a strategist at Rivkin Securities in Sydney. “The non-farm payrolls last week indicate there’s no rush for the Fed to raise rates.”

Markets in Canada and the U.S. resume trading on Tuesday after holidays, and data on services output in the world’s biggest economy are due. Fed Bank of San Francisco President John Williams is due to speak and his comments may help shape the outlook for monetary policy. The probability of the Fed opting for a September rate hike fell by 10 percentage points last week to 32 percent, futures prices indicate.

Stocks

The MSCI Asia Pacific Index rose 0.4 percent as of 1:42 p.m. Tokyo time, after advancing 1.3 percent in the last session. Japan’s Topix index climbed to a three-month high, while benchmarks in Hong Kong, India and South Korea were headed for their best closes in more than a year.

Futures on the S&P 500 Index added 0.1 percent, after the gauge rose 0.4 percent on Friday. Bayer AG sweetened its takeover bid for Monsanto Co. a second time on Monday, saying it would be prepared to pay $127.50 a share for the U.S. seed giant provided a negotiated deal can be reached. Monsanto ended last week at $107.44 in New York.

Currencies

The Bloomberg Dollar Spot Index was little changed, after slipping 0.2 percent on Monday. The yen weakened 0.2 percent to 103.68 per dollar.

The Aussie appreciated 0.5 percent, the best performance among major currencies. The RBA kept its benchmark interest rate at 1.5 percent in Governor Glenn Stevens’s final meeting, a decision forecast by all 26 economists in a Bloomberg survey.

South Korea’s won and Taiwan’s dollar were both near two-week highs, with the latter advancing 0.3 percent.

“Asian currencies will be especially sensitive to comments from various Fed speakers this week,” said Khoon Goh, head of regional research at Australia & New Zealand Banking Group Ltd. in Singapore. “Any talk of September still being live should see Asian currencies give up some of their recent gains.”

Commodities

Crude oil traded at $45.28 a barrel in New York, 1.9 percent higher than at the end of last week. It climbed as high as $46.53 on Monday before retreating after Russia and Saudi Arabia — the world’s two biggest producers — ended talks in China without agreeing any concrete actions to support prices. The two nations will attend talks this month in Algeria with other major producers and Russian Energy Minister Alexander Novak said Monday that they both view an output freeze as the most constructive instrument.Aluminum rose 0.2 percent in London, after sliding more than 2 percent over the last two trading days to its lowest level in almost three months. Goldman Sachs Group Inc. warned that metals including aluminum and copper are poised for a retreat this year as Chinese demand wanes. Lead and tin retreated from their highest levels since the first half of 2015, with both declining 0.5 percent.

Bonds

U.S. Treasuries due in a decade were little changed from Friday, yielding 1.61 percent. The rate on the two-year notes, which tend to be more sensitive to the monetary policy outlook, increased by one basis point to 0.80 percent.

Japan’s 30-year bonds rose for the first time in two weeks, pushing their yield down by two basis points to 0.505 percent. An auction of the tenor achieved a higher-than-estimated price on Tuesday and the bid-to-cover ratio rose from the previous sale. [Bloomberg]

FTSE 100 Outlook and Prediction

Initially on the 30min chart there is a bit of weakness as we have a red coral (trend) indicator, with resistance at the 6901 level. The 2 hour chart however shows support at 6861 still, so I think we might see a similar pattern to yesterday with a drop down to start with, but possibly with a stronger bounce today.

We have S1 at 6853, the 200ema on the 30min at 6850ish, to go with that 2 hour support so I think this area is worth a long to see if the bulls can push up towards the top of the Bianca channels. Just above them we have the recent high at 6930, then 6957, which are the two Raff channels. Above that we could be looking at 6980 and then the round number 7000.

So, if the bulls can hold onto that 6850/6860 area then we could well be on for some more upside, building on Fridays NFP rise. However, below this area then the bears will be keen to take the FTSE 100 down to the 6740 area where we have the bottom of the Bianca channels. Worth shorting a break of the 6850 area (30min candle close below that level).

Good morning! guys shame really it didnt rise much for my long yesterday !! though adding morning gains to it day was quite productive for me. Currently Long @ 60 stop is tight. good luck

stop moved to b/e

Si – you still there? more importantly are you still short?

I think Si threw in the towel on Friday 🙁

Oh no, bet its all downhill now

Si – you still there? more importantly are you still short?

stopped out ! long @55

Closed 1/3 of my shorts at 55, will close another 1/3 at 800 ish or if it goes up will add to short at 900 ish

No longs all short.

Breakout out of 6859 short – 50 /pp

The lower barrier to the price action has broken

Looking at 6845 as 1st target 6839 as 2nd

an 6828 as 3rd

lets see if i will be able to add

so fingers ready atleast we hace servisces pm1 in 2mins

labout market & ism nin manaucturing in 15 all movers

boe gilt buyback – another mover

fingers on button to add

8 mins to go ism non manuf 6844

another 50/pp 6835

now 150 /pp

4 mins to go – total 200/pp

will try to get out < 28 if possible

finger on button

too heavy to let it retrace

got 1 min to news

still looking for sub 6828

6819 – fingers on button

still in 6826 –

final target 6800

donbt want to give back progits

still in at 6824

could this go to my final target 6800

will not add anymore though

but fingers to cut

news out – iran willing to cut oil production

looks liek oil may go up

looking closely – will take ftse with it

6826 still – ready to cut

had to press the button

got out 6827

still good profit £3800

but small voices in the head saying

“could have” ” would have ” at 6819

got to get over this

Afternoon all,ISM non mfg at 15.00

https://www.forexcrunch.com/eurusd-trading-us-ism-non-manufacturing-pmi-5/

Great trade JSft.

Looking for 800 to pull some more of mine. I added a short on sp500 @ 81 as soon as data came out. Doing ok thus far.

I will be all out ( in a good way) on FTSE if this goes to 750 which is the first time in a while!

Good luck all

thanks morko

your’re not doing bad as well with your style. but as you can see I like adding to winners/

1. ya there is still a very good possibility for ftse to go to 6800

good round number as well

2. I still prefer the Up breakout – so cashed in early

3. however good news is that the breakout is around 6900 now instead of 6930. will be able to get a better figure after close

I need to master adding to winners…I see you do it with good affect.

I wouldn’t like to say what the next move is. A host of uk data tomorrow but I think the US rate and economy is more of a driver at the minute.

Hi gang been travelling most of the day…Now long ftse @ 6840 and short ftse @ 6785….

Hi George, please can you run me through how being long and short at the same time is beneficial? Wouldn’t it have been better to be stopped on the 6785 entry on Friday and then reenter? As now don’t you need a big move then counter move just to get out of the trades? Sorry for the questions but I’m new at this and wondering on strategies!

Still holding shorts…made good return today but I do get a sense the market sentiment and outlook is turning from

Bull to Bear – What’s this based on I hear you cry…well nothing concrete to be honest just my conclusions and reading between the lines from the raft of news, reports and everything else…Please draw you on conclusions and share.

My plan is to start buying at sub 6730, equally will short again at 6895 and add in as required. What goes up and all that.

Just sharing thoughts.

Apologies for shocking typos, I’m on iPhone and drinking a pint!

hahah good man 🙂

Looks like the only influence tommorow is going to be manufacturing prod m/m

Influence yes – but in the last year – very little effect on the moves.

rest of the economic news is thin in terms of influence incl halifax hpi & inflation report. brexit would have influenced this and the market is going to shrug this off whatever.

canadian rate is not going to move and will be a non starter.

reckon that all we are left is sentiment. and that is undecided and will drag the market higher.

with thursday being the influencing day with rates in eu – tommorow looks like a drift.

S&P wants to get to recent highs so ftse anticipation of this is going to move it higher.

breakout higher is 6880 – so hoping to get in. down breakout is the round no. 6800, not anticipating this

so this is what i am going to turn off my pc with.

tommorow pre open may bring suprises – doubtful

——-

if anybody else has any thoughts – pls pen it.

alternative views are what makes the market.

Added to my S&P500 short @ 2186. Have a tight stop but really at these levels with data showing a sign of ‘slowing’ in us I feel relatively confident it will head south.

There is more and more talk of a correction – tomorrow would be nice. Lol.

JSft, great post, i appreciate it as there are few to air our thoughts too and debate with. …my wife certainly isn’t interested ( only when I win) . GL tomorrow all.