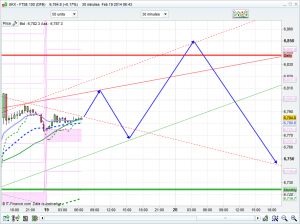

Good morning, worked out well yesterday though sods law prevailed and it just missed the long order level at 6715. Maybe just a little too exact there. Anyway, the short from 6755 worked out well and sure enough we got the rise and then a bit more at the end with the divi hunters to just stick the head over the 6800 parapet. It topped out just before the close at 6806, which was the Bianca 20 day channel top, that level has changed today to 6856 (10 day is 6849) so if it gets bullish again, 6850 looks a good shorting area.

I mentioned yesterday that the weekly chart had resistance at 6793 so now we are around this area we could well start to see some bearishness. The media are getting a bit frothy again with how amazing the UK is doing, and with inflation falling to 1.9% yesterday things do appear to be picking up. House prices still look like they are overheating though! Just hope people can still afford the mortgages they are taking out when rates return to 3 or 4 or 5%. Credit bubble 2 anyone?!

Asia Overnight from Bloomberg

Oil and natural gas gained before data forecast to show U.S. stockpiles fell on heating demand, while silver led losses in precious metals. Chinese shares rallied to a two-month high, Japanese stocks slid and Thailand’s baht weakened.

West Texas Intermediate crude added 0.4 percent by 3:01 p.m. in Tokyo and natural gas climbed 1.7 percent. Silver sank 1.1 percent following a 13-day rally. The MSCI Asia Pacific Index was little changed, the Shanghai Composite Index advanced 0.9 percent while Japan’s Topix slipped 0.5 percent. Futures on the Standard & Poor’s 500 Index (SPX) and FTSE 100 Index were down 0.1 percent. The baht dropped 0.3 percent after clashes between anti-government protesters and police in Bangkok escalated.

Minutes of the Federal Reserve’s January meeting and data on U.S. housing starts and U.K. employment are due today, before a preliminary report tomorrow on China’s manufacturing. Violence in Thailand killed five people, while a crackdown on protesters in Ukraine left at least 18 people dead.

Chinese Manufacturing

The Shanghai Composite Index rebounded from yesterday’s 0.8 percent slide after overnight money-market rates dropped to a nine-month low, signaling ample cash supply even after the central bank drained funds. The Hang Seng China Enterprises Index in Hong Kong erased a decline of as much as 0.9 percent.

A flash estimate of China manufacturing was unchanged at 49.5 in February, HSBC and Markit Economics will say tomorrow according to economists in a Bloomberg survey. A final reading in January fell below 50 for the first time in six months, indicating contraction.

S&P Futures

S&P futures signaled the gauge may retreat after gaining 0.1 percent yesterday. U.S. housing starts probably fell 4.9 percent in January following December’s 9.8 percent drop, according to economists surveyed by Bloomberg.

In the U.K., the unemployment rate held at 7.1 percent in December from the previous month, matching the lowest since March 2009, the median estimate of economists polled by Bloomberg shows before data today. The Bank of England will release minutes of its Feb. 5-6 meeting when policy makers kept the interest rate at a record-low 0.5 percent.

FTSE Outlook

There is more and more positive press coming through to suck in the buyers to wrap up the tax year and pump into the ISA’s, so I expect that we will soon start to see a dip again. We have had a decent bounce off 6400 after the bearish January, so this rally might start to run out of steam soon. should it reach 6850 I think that will be a good short area to hold for the rest of the week, though as you can see with the arrows and resistance levels mentioned below, it needs to break 6808 before that. If it all goes pear shaped and the daily pivot at 6771 breaks then its likely to reach 6752, though I think that the pivot will hold initially. The bottom of the 10 day Bianca channel is 6727 – a level that is worth a long if seen. Before that a small short at 6808 with a widish stop could be a good play today, with 6820 as a level to back it up as an adding area – i.e. fade in the shorts.

Look what dropped into my inbox today……..could have almost written it myself….including expecting the FTSE to be near 7000 at the end of the year!

19th Feb. 2014

How will UK equities fare in 2014 and 2015?

UK equities underperformed other major developed markets significantly in 2013 and have fared

no better than their American and European counterparts since the start of the year. But we think

this underperformance is likely to be reversed over the coming years, for two key reasons.

First, the UK is at a relatively early stage of the earnings cycle. The profit share in the UK is close to

its cyclical trough reached in 2010, and is more than two percentage points below its peak. In

contrast, the profit share in the US is close to a record high.

Granted, we do not think it will be entirely plane sailing for UK earnings. For example, our view that

energy prices will fall over 2014 and 2015 may prove to be almost as big a drag on the UK’s natural

resource sector as the falls in commodity prices seen in 2013. This would weigh on the headline

FTSE 100 index particularly heavily, given that around a fifth of firms in the index operate in the oil

and gas industry. But to the extent that lower commodity prices contribute to lower input costs, other

companies in the stock market would benefit from this development.

Second, we are relatively upbeat on the outlook for valuations. Price/earnings ratios are below both

a historical average and those in many other major equity markets. This suggests that there is still

significant scope for UK equities to gain before they appear ‘overvalued’. In contrast, stock market

valuations in the US appear stretched on a number of measures. What’s more, historical experience

suggests that the turn in the profit cycle we are forecasting for the UK is likely to be accompanied

by a rise in valuations.

Admittedly, we think it is unlikely that the FTSE 100 will match its performance in 2013 in absolute

terms, when it rose by 14%. This largely reflects our view that global equities will struggle to post

significant gains at a time when the Fed is withdrawing its monetary stimulus.

Nonetheless, we think that UK equities are poised to perform better in relative terms. We forecast

the FTSE 100 to rise from 6,760 at present to 7,000 by the end of this year and 7,500 in 2015. This

would be a larger percentage gain than implied by both our US S&P 500 and German DAX 30

forecasts.

And who is the “We” who send you that??

Capital Economics.

I think we are for a bit of a shock later this year. The economies are not doing as well as everybody think. For growth you need investments and over the last 5 years all the big businesses have been buying own shares and not investing in the future. Just yesterday we were told that credit has grown in the US at the fastest rate since 2007!! that would indicate that the grow is stimulated by credit and that is never a good news. All its going to take is increase in interests rates and we will be in a bigger shit then in 2008!

In the UK we have pretty much the same situation…..people will not get compensated by higher earnings to offset the interests rates increases and you better believe that they are coming!

Not to mention the Chinese credit bubble. 😉

I do agree there are substantial downside risks out there. However do I see a crash in 2014? To a degree that anyone can forecast a crash I do not. The Sub Prime meltdown and GFC of 2007 / 2008 were predictable as was the ensuing Sovereign debt crisis.

Interest rates in the UK will not rise in this year. Inflation is below the target and unemployment remains above the stated rate before they will consider raising rates. Even then they have already shifted the goalposts to ensure that the can is kicked further down the road.

I don’t think it will be a stellar year – as they suggest barely flat in the US and no more than a 4% rise on the FTSE. Alternatively if things do turn sour I still believe that the FTSE will be a better place relatively to put your money rather than the US. Asia or even Europe.

Predictable, but yet not many have seen them coming….otherwise we would have sooooo many very rich people!.. :-)….

If you look at this cunning price then at Dow it escaped the rising channel but it didn’t on FTSE. I will probably have to readjust my rising channel as there’s no signs of sell off and it will probably pop up higher again. Maybe to reach that 16166 again from where I tried to short on Friday.

I’m not going to short in a big hurry today though. GL

Hi all, will 6771 hold ? anyone ready with long order @ 6771?

currently short from 800 Senu looking to close 70’s to go long for afternoon session

Well done mate 😉

thanks Senu out at 76 looks like it might go lower but happy with what I got

Got in a long in the morning @ 6790 saw it rising then had a bit of a work to do so didn’t set me stop to BE as I always do once in profit and now stuck in a loosing trade and it isn’t looking good probably just will close it as it is looking weak…

Oh, what a shame, I though you would have 20 point out of it.

pivot going

long at 62 stop50

Well done to anyone who shorted at 6800.

6808 here 🙂

Cannot believe Nick has shorted 808. How come and what time?

Great call. I wish I was doing FTSE still then I would subscribe.

I stopped it for now as it burned me on that short in January.

looking very bearish not bounced as I thought it might at this level

Instead of making a nice 20 points now loosing 30 and the drop I was looking for at us open for the last few days probably will happend today… Annoying

It’s coming back. You may reduce your loss.

Anyone still looking to go long for the afternoon?

BOUNCING COMEON..

First 2 arrows done; will the third play out?

Well done once again Nick 🙂

Thats a yes then!

hope so Nick I’m long from 62

ok, have longed at 6760….signal from my new strategy (its a small trade – not as confident in placing this trade as i was with my old strategy)

I was hoping for 6741 dont think we would see that.

I havent coded any of it btw, these are calculations ive done manually, adjusted my indicator to “Hopefully” catch trends eariler, which increases probability of bad trades, which is self explanatory.

If i get several bad trades in a row then i will most likely run it on demo and stick with my old strategy in live account

What new strategy it is? Fib levels?

Wanking with a condom on

markets waiting for housing starts and ppi at 8.30

DOW sat right on 200ma on 30mins makes me feel better we might bounce off it. Got the new PPI out today

does look like a double top on ftse at 800

I am out closed my long for 2 points till news out looks to me like it is going over.

up to 6808 then followed down to 6780 talking profits happy 🙂 makes up for my stupid trades yesterday :\

back in at 6764 let hope the US lean on the buy button for a few hours

starts down ppi up so where do we go!!!

back in long at 71 with tight stop

Closed now. Lost 12 points.

everyone having a siesta

Short @ 6775

Are you still approaching this from your old “pick up 10-15 points” strategy? Or are you seeing this as the top for the reversal?

(Just like to know people’s thinking behind trades that’s all 🙂 )

always 10-15-(20) pts 😉

🙁 out @ 71

sorry to hear that, fed mins seems to always pushes up dow

was so obvious today was the day to go long dow before open but fear stopped me!! 🙁

I still feel it should fall. Short @ 6780 and will hold till 4:30

why short atm senu-sometimes you gotta go with the flow gl

yes, I had a discipline not to trade during dow opening, but couldn’t resist. Learning 🙁

senu used to do same find now if I stay out till 2.40-3pm seems to have settled

Tbh I only trade during Dow open and trade Dow. Why to be scared to trade during Dow open? It’s moving that’s important.

It had 1 higher low before 2.30 open then it burst though the lowering channel and it was time to go long at 14.32-35 to be accurate.

On FTSE before 14.30 it was a lowering channel too which burst nicely at 14.35 and it was time to go long.

All MA support nicely, nice reading on 10 min chart.

Oh well it was a good day in regards to signals.

dow is racing 100 pts up from low

gutted!!

got a cheeky on one at 16121

🙂

been holding this long from 6766 since the first time it hit- finally paying off 🙂 gl guys

I wish FTSE falls 20 pts @ close 🙂

This is getting very hard to trade for me huh not good days for me last 2

should be more upside after close

Ive done a “jack two”, and built a huge short at 6740.

Im gonna hold it, waiting for a 6400 by early march.

Didnt expect this much upside though.

🙂

Well, I hope you won’t need to recover as long as I did from that loss.

Woow that sell off was sudden-what caused it.

Got your wish senu 🙂

Yes. Narrow escape. 🙂

Fed Talking .. and the minutes coming at 7 for the last fed meeting

Wow! Thank God. I booked profit 🙂

im still holding long from 6760….hoping for a choppy upside.

Yes. I think this early intraday bounces sometimes are alerts for a big move up.

Or down

Looks like some shooting stars being formed here, looking very bearish .

Big Gap fills in morning. Worth a long.

Waiting for a good long re entry.

What the Hell. The most striking scene I’ve ever seen (looking at Dow and FTSE charts).

Nick’s arrows were spot on though. Who would have thought. Wow.

Andy what I thought as well so went long at 57.

IHS in SPX. Right shoulder in formation

Pms meaning

Pms yes c the inverted head & shoulder so up and sideways for a bit before drop

Marco u still holding long. I got more FTSE at 6747

Short @ 6756, tight stop

Going for gap fill added to longs at 37 and 47. Shooting star on the Dow last night. Was it an over reaction anyone’s guess.

looking forward to pullback over next few days…!

quite a way back up to 97 so expect last bit up will be on Dow open then drop

Added 3x long at 6735 all closed at 6765.

Looking for a drop/stangnant market till US open hence why i closed longs at a good profit

Yes. let FTSE fall 🙂

she wants/must fill this gap as big drop coming AIMHO

72 proving hard keep chipping away

I think we got it