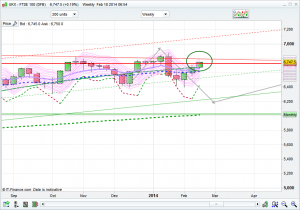

Good morning, well that was interesting yesterday, FTSE had a trending day (days which I hate unless already in a trade) and blew through all of the lower resistances before stopping just shy of the more major 6755 area. Typical! Interestingly the Dax hardly moved while the USA was closed for their public holiday and overnight the FTSE has maintained its strength. With this bounce from the 6400 area the other day things are certainly looking up for the FTSE at the moment and the Bianca channels are now showing 6800 channel top areas – figures that are likely to rise if we have a few more bullish sessions this week, whilst the daily Raffs are topping at 6850 currently. The all-time highs are still there for the double top at 6950ish! Despite that sell off to 6400 things seem to be recovering quite well but it probably won’t take much to upset the apple cart again and the weekly chart has ProTrend resistance at 6793 still.

With the overnight session being quite upbeat, bullish Tuesday and a divi of 14 points, there doesn’t seem to be much to be bearish about. Probably just the reason for it to drop! That said 14 point divi will bring the buyers in just before the close so expect a rise about 16:15 to 16:29 today.

Asia Overnight from Bloomberg

Asian stocks rose, with the regional benchmark index poised for a three-week high, after the Bank of Japan maintained unprecedented asset purchases and boosted lending programs. Chinese shares fell as the central bank drained liquidity from the financial system.

The MSCI Asia Pacific Index added 0.6 percent to 137.12 as of 1:32 p.m. in Tokyo, heading for its highest close since Jan. 24. Global equities erased this year’s losses after Janet Yellen’s first testimony to Congress as head of the Federal Reserve and China’s record lending buoyed optimism in the world’s largest economies.

“The broad market uptrend remains intact,” said Nader Naeimi, Sydney-based head of dynamic asset allocation at AMP Capital, which manages $131 billion. “Japan is in a unique situation as the BOJ continues to add stimulus, while the Fed is beginning to taper. Liquidity tightening in China shouldn’t be a concern as policy makers need to mop up excess liquidity. There’s enough credit available in China to support growth.”

Japan’s Topix (TPX) index jumped 2 percent as the yen weakened. The nation’s central bank pledged to maintain plans to expand the monetary base by 60 trillion yen to 70 trillion yen ($686 billion) per year, as forecast by all 34 economists surveyed by Bloomberg News. It doubled a funding facility to 7 trillion yen and said individual banks could borrow twice as much low-interest money as previously under a second lending facility.

China’s Shanghai Composite Index fell 0.5 percent, retreating from a two-month high. The nation’s money-market rates climbed as the central bank drained funds from the banking system after new lending reached a record.

“The central bank has realized there’s a need to soak up some liquidity,” said Wang Weijun, a strategist at Zheshang Securities Co. in Shanghai. “The process will pressure stocks.”

FTSE Outlook

Ah the FTSE loves a good game doesn’t it. When everything else remains static the FTSE adds 70 points. News of a slowing China yesterday had no effect whereas a week previously the same news was the end of the world. Just goes to show how the news is matched to the price action rather than the other way round. We are nearly at the resistance areas mentioned yesterday at 6755/65, which ProTrend have conveniently plotted with a 30 minute channel as well. as such I expect an initial dip from this area, ideally to the bottom of that channel at 6710ish, before further rises, though the drop might stall at 6725. That said, we also have the daily pivot at 6714 so a fair bit of support around this area – 6710 to 6725ish. Its bull Tuesday, and we have a big 14 point divi today. As such bear in mind the note above about the buyers coming in at the close to get the divi.

Just re entered long

X2

I am long from 22, this will jump up on American open. I am expecting it to fall this evening after we close though when SPX hits 1850 so will aim to short then

I think that long due drop at us opening will happen today…shorted S&P @1839 already in profit moved stop to BE so no risk there. Will see….

Is anyone else long here?

I was at 6719. Closed at 6730. Unsure today, especially with some of the data out/due.

Im long not sure how to take US opening though.

Great insight as always nick good call today again…i was short from 751 closed early at 733 -and den went long there then i got stopped out at 715-and now long from 718..not bad overall…not expecting tooo much volatility come us open though but that remains to be seen, given the beast that the dow:) gl guys

nick the channel lines are you creating them or generating them from a tool?

They are automatic, called ProTrend lines, they are on the charts that I use, just need to turn them on.

I think the sensible approach would be to close this long which is why I am leaving it open! US is going to punch 1850 today I believe

X2WLT! What is your stop on your long? Thx

Bee I don’t have one at present. I have gone small to add if we get as low as 6600. I will be out if we get another 30 points though.

Might put a stop at b/e

Off topic but Apple meeting Elon Musk is pretty exciting. iCar?!

Thx. Good plan. I am looking to get 1832. ( not looking good ATM probably will be stopped) GL

Got my limit set at 6773

Cheers mate 😉

Nick, your chart is completed 🙂 good one, what next?

Retire

NAAA not yet !

Waiting for your Divi at 16.15

Limit taken off. Greed

Greed is the main killer for traders 🙁

If i have a winning trade, and i’m happy with the level of profit it is at relative to my initial target, instead of setting limits, better to set stops in profit, so if it keeps running up you don’t lose out, and if it falls then you still book most of the profit you have

Good advice white. I have moved my stop to lock in some profit. Still feel this has a way to run

Just exited my long. Good couple of days

6715 you nailed it (again) Nick

Im now agreeing we need to see a small pull back to 6700. But will not short as we may be on towards the new highs.

FTSE really fucked up the shorters yesterday and today. Keeps running still

Even a flat US cannot stop it?!

Ahwab, are you still holding your shorts or stopped out?

Senu where have you been ? Did not see you here in the recently mini-crash 😀

Or you avoid lots of volatility ?

No. Just a pause for trading because of loss.

Sorry to hear that – but we all take a loss sometime. The key is not to get wiped out.

Hi Javed, How do u do 🙂

I’m good sir. Having a decent start to the year……but as we all know it is a rollercoaster. Enjoy the ride….but take time out to smell the flowers too otherwise your bp will go through the roof!

Will we see a break of 6800 today? didn’t expect this rise

well. answered my own question – I’m out at 6800 and putting in a short overnight.

I think this run is because of the 14 point divi. If it so, there will be a sell off @ tomorrow opening for profit booking. Can anyone confirm this?

6800 has come as i predicted last evening, but not earned single point 🙁

Tempted to short even for 25 points

I’m in short

Anyone know where the likely resistance points are on the way back down?

great call on 6715 support

If DOW starts to climb mid session or after lunch, the FTSE shorters will be burn tomorrow

ha ha 😉

Most likely – otherwise I would have shorted ftse, damm DOW!

Looking good to hit the 7000 mark sometime in April, as mentioned previously. No doubt thought we must take a breather in March or shortly. This rapid rise of 340 odd points in the last 10 trading sessions has surprised me but welcomed as I’ve been long. What hasn’t been a surprise though is that the FTSE continues to outperform the US (but not Europe). That I do believe will be the continuing theme of this year.

Thanks Javed

No problem. Potential long term spread trade this year – Long FTSE v Short Dow if want to limit the downside risk.

Javed, if you don’t mind can you share how you pick your entry point(s) to long term trades (short or long and stops). You can mail me mailtosam10@gmail dot com.

Will email you. But not much to say as I don’t pick entry and exit points as such. I trade months or quarters depending on the direction predicted by my model. So currently I switched my short into a long at the close on 31st Jan and will hold it till the close on 30th April.

Closed short for 2 points! Too scared to hold it as I am bullish

FTSE only 100 points away from my target for end Feb.

Not bad considering my prediction was very close for the correction as wel.

Let’s see now where it ends up around 17 March, my prediction was 6250.

Gl all 🙂

Pull out at. 6720 with a small loss yesterday it stayed too strong not too different from last Monday where the following day it rose. Made some profit today but it bugs me how the other indices don’t move. IMO in hindsight the ftse is just catching up with the DAX and DOW as it was languishing below its highs while DOW and DAX just went full throttle towards the end of the year. Long atm, 6800 is a defo target.

Gl all

I do certainly think there is an element of that. My view from a fundamental perspective has been the FTSE will outperform the US this year as taper fears take effect across the pond and we get some decent growth here. So far it seems to be going that way but still very early doors……..

There is certainly an element of that. My personal view has been that from a fundamental perspective the FTSE will outperform the US this year as tapering takes an effect across the pond and we get decent growth here. So far it seems to be the way but of course far too early to be certain.

what is your target for DOW, when you exit FTSE in April 30 ?

I’m not trading the Dow or the Hang Seng this year. Just concentrating on the FTSE as it maintains my trading and risk discipline.

Aside from my usual strategy I am suggesting a possible long term spread trade – Long FTSE v Short Dow to hold till 31st Dec. I wouldn’t have a target for the Dow as such or even the FTSE for this trade, but am currently expecting the FTSE to be near 7000 at the end of this year.

you will think DOW goes the opposite direction of the FTSE, and doing so, all major markets will follow, except FTSE.

Never saw this happening in the past

Not necessarily thinking it will go in the opposite direction – just that the FTSE will move more percentage wise relatively to the Dow.

I think it will outperform – meaning if the Dow goes up the FTSE will go up higher, if the Dow falls the FTSE will fall but less.

Follow your thinking, the best I can see is a flat DOW and FTSE up, but even that looks a bit odd.

6900* area

Twitter : @PMSTrader,

Currently this year the Dow is down 2.64% whilst the FTSE is .7% up. The FTSE underperformed the Dow last year and quite rightly so as the US was pushed up by the stimulus and the UK was stumbling along. As we know too well markets don’t always follow fundamentals but it would seem a reasonable view that this year the conditions will be reversed. Anyway for clarification here is an example if we had executed this trade on 31st Dec:-

31st Dec Contracts GBP Equivalent

Dow 16,577 -2 -20,024

FTSE 6,749 3 20,247

FX 1.6557 224

Dow / FTSE Ratio 1.48

18th Feb

Dow 16,139.00 -2 -19,334

FTSE 6,796.43 3 20,389

FX 1.6695 1,055

Dow Profit 524

FTSE Profit 142

666

Not sure if it is going to come out too good here though.

Anyone else looking to short ftse overnight?!

im with javed, this time around we will be breaking 6950 high.

im not long yet, starting to get a bull market in my indicator…definetly been a rough one in terms of catching trends early.

hopefully get a dip on the claimant count tomorrow to enter a long at a nice level.

I have been long but if we see 6850 tomorrow I will start building short. This year will be volatile which is great for us. Hash I think if your indicator is turning bullish 400 points above the dip it may need resetting?!

lol that thought has crossed my mind…but then i looked at it, we have been stuck in 400 point range for very long time, my indicator looks for trends, and i think we will be breaking 6850!

also im modifying it currently to catch trends quicker, however it seems to be churning too much (u prob saw me writing here couple days ago saying im bearish and the next day im bullish etc).

To do this i need to spend quiet a lot of time in matlab, doing it very slowly due to most of my time being spent on my phd.

I’d rather just work on it slowly and keep trading with the current strategy which has been shown to be profitable for 3 years now, than mess around for quicker profits and end up f**king everything up!

Hash I love reading your trades and they help me a lot. GLA