Good morning. Both shorts yesterday worked out, though the first not as well as hoped. The bulls came out as the price hit 6420ish and we got a pretty fast climb, but then no break of the 6480 area (second shorting opportunity). That said, we are back testing that level and things are actually looking a little more hopeful for the bulls, especially if the Dow holds this current level. Twitter results were out last night, an initial share price rise of 6% was quickly reversed to a 13% drop. The joys of tech stocks! User numbers levelling off and a whopping Q4 loss spooked investors. Eyes will definitely be drawn to NFP tomorrow as the next major news item to see where next for stocks.

Asia Overnight from Bloomberg

Asian stocks advanced for a second day while Australia’s currency climbed after the nation reported a surprise trade surplus on exports to China. Commodities gained, with silver, gas and nickel rising.

The MSCI Asia Pacific Index added 0.3 percent by 3:15 p.m. in Tokyo, as Australia’s S&P/ASX 200 Index snapped a three-day losing streak. Standard & Poor’s 500 Index futures rose 0.2 percent after the gauge slipped a third time in four days in New York. Australia’s dollar strengthened 0.6 percent versus the greenback. The S&P GSCI Spot Index of 24 commodities rose 0.3 percent as silver added 0.6 percent, gas rebounded 3.8 percent and nickel advanced 0.7 percent in London.

Stocks are rising after $3 trillion was wiped from equities worldwide this year amid a selloff in emerging-market currencies on cuts to U.S. Federal Reserve stimulus. Australia reported an unexpected trade surplus of A$468 million ($420 million) in December as two-way trade with China hit a record. The European Central Bank and Bank of England decide on monetary policy, while investors await data on U.S. jobless claims today before payroll and unemployment reports tomorrow.

“China is Australia’s biggest trading partner for its iron-ore and coal exports and the two countries are intertwined with each other,” said Nagayuki Yamagishi, senior analyst at Money Square Japan Inc. “The increase in exports to China is very positive for the economy. That eases recent concerns over emerging markets and can support the recovery in global growth.”

U.S. Economy

U.S. unemployment is forecast to have held at 6.7 percent in January, according to economists surveyed by Bloomberg ahead of a monthly jobs report tomorrow. Companies in the U.S. boosted payrolls by 175,000 in January, according to data from ADP Research Institute. Payrolls rose 74,000 in December, missing the median analyst projection for an increase of 197,000

“Markets overall will be in a holding pattern until we see U.S. nonfarm payroll data on Friday,” said Tim Schroeders, a portfolio manager who helps manage $1 billion in equities at Pengana Capital Ltd. in Melbourne. “Emerging markets and the rate of U.S. growth are two things people need to get their heads around.”

Philadelphia Fed President Charles Plosser, who votes on policy this year, said he expects the economy to expand 3 percent in 2014 as the jobless rate falls to 6.2 percent by year-end, warranting a quicker tapering to bond purchases by the central bank. Policy makers made the first two cuts to asset purchases in December and January, slowing to $65 billion a month from $85 billion.

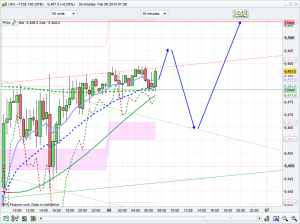

FTSE Outlook

Today’s pivot is 6455 and there is quite a high chance of that being hit this morning before a bounce. The bulls tried to break it out upwards yesterday by breaking 6480, then got smacked down to 6444 (this was 3pm). I wonder if that was a sign of things to come and the bulls were just a bit too quick out the blocks. Interestingly yesterday the Dow and S&P stayed relatively stable while the Nasdaq dropped a bit more – maybe brining everything into line for a bounce. As a slightly bigger picture, I think the FTSE could reach 6600 on any bounce before declining again to 6200 or lower (following the weekly chart below).

For today it does look bullish, and has held up overnight; there is a 10 minute channel in play with resistance at 6495 initially and support at 6470ish. Should that break upwards then 6515 and 6580 look likely targets (top of the 20 Raff channel is 6580). We are testing the top of the 10 day Bianca channel as I write this at 6483. I think that we will get a generally bullish day (especially if 15440 holds on the Dow, next support on Dow after that is 15360 though). There is a fairly decent channel on the 30 minute chart as well, the top of which we are currently testing; support is 6445.

Hi Nick,

I’ve been following your site for a month or two and will be signing up to your monthly membership in the next few weeks. Can I ask what trading platform you use? I currently use Plus500 but the FTSE futures contracts on there can be up to 50 points behind and never know whether your levels are the actual FTSE levels or futures levels?

Nicks levels are the FTSE Cash levels, not future levels

Thanks White,

Which trading platform do people prefer on here? Plus 500 keep upping the minimum contracts I can buy / sell and therefore increasing my risk management, which has an an adverse effect on my trading balance.

Hi Lee

I use IG, daily cash for my trades. Occasionally i use a futures contract if i am going to hold for a few days/weeks. I tend to do those trades off the daily channels.

Thanks

Nick

Spot on nick! I went long a bit to early at 6480 and got stopped out at 6460-sods law..currently long from 6468 though so its all a good. I use igmarkets aswell lee-good luck trading guys

Thats me all done today. Perfect morning and all done by 10am. Short 6495, closed at 6465, then Long, closed at 6495. If only every day was like that!

This bounce is almost convincing. 🙂

Jim you looking at one more low into NFP Friday? Indices at important levels currently

Why is 6510 an important level ?

Has anyone else’s IG stop requirement distance moved to 12 points?

Shorted 6520

Looks to me like a ECB rate-cut is coming with this rise.

… could be a buy the rumour sell the fact scenario going on here 🙂

I’m eyeing up 6560 area as a 78.6% retracement of the 6598-6417 levels to go Short

Time to buy the dips all the way to 6600, me thinks.

Did a bomb go off ???

What was with the 150 DAX point spike ??

It just did if you were holding the Dax long as it spiked down 2% on my IG screen- you’d be mighty upset if you had a stop loss and just took a 2% loss on margin which thankfully I dont

I know it did you fluff ball…

BUT WAS CAUSED THAT TO DO THAT ?

Hey, no need to get sarcy – i have no idea what you are watching

IF you have no idea why are you answering you dic

That Dax move was a monster.

Why did it do that

Malfunction with the data feed imho… Although be interested to know if peoples stops were taken out. If so i’d be on the phone to IG complaining

be even more interesting if they allow you to keep your winnings ?

Stop was at 6493 absolutely gutted.

fat fingers freddy strikes again ?

I was short this morning at 6480, got stopped at 6503.3. It feathered this briefly, and went not a fraction higher! Minutes later it was in the 6460s.

Them’s the breaks!

Clawed back now with shorts at 6515 and 6525 down to 6501 and 6497 respectively. Wild action in the last 2 hours….

im back to being bearish on ftse, looking for a bit higher before i short.

Are you able to explain why you are bearish please?

Would be nice to hear an opposing view-point.

6520?

Ive entered a small short at 6520…

I am very itchy on this short, might take it out at a small loss.

The reason why i am short is purely based on my indicator, and not my economical views.

The reason I am itchy on this short is because i believe the nonfarms will be goodmeaning this short is a bad trade…if i dont see a decent drop (below 6500 before close today then i will be forced to close my short at this point and wait for a higher price).

The bearish signal i have got right now is quiet weak.

closed at 9pt loss…

lets see where the market takes us

i’m short at 6525, stop c.6535.

Could break that, I guess….

Lucky you closed for just 9 pt loss!

well keep the loses minimal when ur wrong 🙂

I’m also long on Twitter for a bounce, from 5119, but that’s another story!

end of today will update my indicator, lets see if it turns to sidelines/bullish…

Am annoyed at myself with Twitter. Thought it was going to bounce last night at 5800 so closed by shorts and took the profit. really should have closed half and then set rest at break even or for small profits, but then it could move fast and be back into negative.

Missed out on around 600 pips ….ahh well

I await twitter to rise again, and then fall

I am have held long from 6497 for the past week. Got a trailing stop in place now, looking for 6600

just closed my long from this morn..done for the day up up and away perhaps? good luck guys

I’m eyeing up 6560 area as a 78.6% retracement of the 6598-6417 levels to go Short

SHORT 6555. Lots of resistance around here

Finally ! A bit of weakness – nicce run that from 6490 6565 O;-)

Yea do you have any downside targets, if it even retraces? Im looking at 6535 initially

Andy – I’m not great at trading ! Ha ha – I’m just following the the Supertrend on the 1 min chart !

Zero uncertainty about tomorrow then! Came out of my long after 40 points and missed the last 40.

I’m in exactly the same boat as you.

More or less gave up my initial gains throughout the day. Did not see this rise being so strong/continual.

Agree.

6200 out the question then? Nick? Thoughts?

Just a bounce in a bigger downtrend. Nothing goes up or down in straight lines.

6800 > 6400 > 6600 > 6200 >6400 > 6000, something like that?

Quite possible! Thanks nick.

Ok, for me now its showing a reversal, but i do expect a tiny drop,

IF i see a little drop I will be going long a decent amount (hopefully before nonfarms tomorrow)

Looks like markets are topping for the day (could be wrong, but all into strong resistance)… Farm Ins tomorrow will be very volatile so i personally wouldn’t start taking positions before it. Im expecting a little drop over the next few hours but tomorrow could be massive drop or massive rise, depends how they want to manipulate it.

I’m currently short and hoping for some weakness. i don’t want to be holding overnight & before tomorrows non-farm release

Well considering how my indicator has moved, i definetly want to be taking a position tomorrow before NFP (at a decent low – which i hope we get in a few hours).

a long position (moderate heavy)

Yep well everyone will be happy if we drop to circa 6535 but better still 6515 or 500.

For the first time in a whole I am now waiting until after non farm news before entering. If we pop to 6600 then I will still be happy entering there for 200 points. I think we will pop higher tomorrow but if we don’t then we should get some great entries.

When you say entering 6600 for 200pts… Im assuming you mean short?

What wud you consider a decent low Hashmash? Overall are we not still rather low?

Looking at the strenght 6560 might be the low haha, but a good entry would be around 6535ish, if i see that today or overnight, i will definetly long something

I really want to long now, but exp has taught me not to rush into it.

Does anyone really think this market is gonna sink down to 6400/6200/6000?

i doubt it, i was predicting 6300 but that didnt happen…

Then again alot can happen.

I’ve been long at 6515 for over a week now so been a little hairy at times! I’ve now placed a stop at entry hoping to hold til tmrow then NFP give me a real lift eventually back to the highs, 6700/6800 over the next week/month. Thoughts anyone???

Andy no I mean if the news is good we are back on the rise up so I can go in with a long and continue buying on the way up.

shorted Dow from 15600 closed for 20 points I think it will be one more low looking for a dip under 6400 on ftse to start building a long till then happy to scrape a few points to grow my capital….

Closed my long at 6570 for plus 73points! Good week! back into profit now from Novembers unfortunate events! Ganna call it a week now due to NFP tomorrow! Have a good one

nice 🙂

long order at 6560…small..about to hit in hopefully..

any further falls tomorrow morning will be adding trade (unless strategy doesnt show it – or markets poop out on me).

SHORT at 6590

Everyone predicting its going to go up makes me nervous, so ready for weak numbers and a drop today heading down to Nicks 6200 level

are you still short Marco?

just spotted your post below !

Marco, do u really think 6200 is realistic even with a poor NFP figure? I’m long 6515 & hoping to hold til we reach the highs again. Thanks.

I think we will see 6515 again before new highs….

would be nice….GL

Closed my short ready for ride up to 6600 then down to 6200

anyone holding shorts ?

Just gone long at 6556

I’m in play. Had an order in last night to Buy at 6550…

My order went to short went off overnight at 6474 and was 2pips off being stopped out before it dipped happy days-currently long from 6452…good luck guys

Im LONG 6556… What we seeing into NFP… Ramp into 1:30pm or drop followed by reversal?

Or secret option 3… Nothing lol