Good morning. Was a bit early with that long yesterday as it dipped down to 6435 before bouncing, probably a slight overreaction while we have the Greek situation playing out. Anyway, the bulls came back from that level for a rise above 6500 and at the moment the short term charts look alright for a positive day today. A rise in European stocks and a positive budget from Osbourne helped. The U.K. will maintain the pace at which it cuts the budget deficit with the new budget, the first by a Tory majority government since 1996. It is the first time Osborne has been able to set out his plans for tax and spending without being constrained by the Liberal Democrats.

US & Asia Overnight from Bloomberg

Asian stocks fluctuated, with Chinese equities swinging between gains and losses as the government tries to stem the rout. Shares in Hong Kong rebounded while Japan’s Topix index slid.

Citic Securities Co., China’s biggest brokerage, jumped 13 percent in Hong Kong, heading for its first gain in six days. China Life Insurance Co. gained 5 percent after UBS AG raised its rating on the nation’s largest insurer to buy from neutral. Honda Motor Co. slipped 1.8 percent as Japanese exporters retreated after the yen jumped on Wednesday amid China’s rout.

The MSCI Asia Pacific Index was little changed at 139.63 as of 11:18 a.m. in Hong Kong, swinging between a gain of 0.7 percent and a loss of 1.7 percent. China’s securities regulator banned major shareholders, corporate executives and directors from selling stakes in listed companies for six months, its latest effort to stem an equities decline that’s erased more than $3 trillion of value. The Shanghai Composite Index climbed 0.5 percent after dropping as much as 3.8 percent.

“The Chinese government is trying their best to provide support in that market,” James Lindsay, who helps manage the equivalent of about $3 billion in assets at Nikko Asset Management NZ Ltd. in Auckland, said by phone. “The selloff is affecting other markets, such as commodities. That combined with investor nervousness around Greece creates more volatility.”

China’s measures are a sign of desperation and will fuel fear among investors, said Mark Mobius, executive chairman of the Templeton Emerging Markets Group.

Government Support

The Shanghai Composite slumped to a three-month low on Wednesday as another round of government support steps failed to allay concern that investors who borrowed to buy shares will keep unwinding those trades at a record pace. The Hang Seng China Enterprises Index of mainland shares traded in Hong Kong, climbed 2.9 percent today, while the benchmark Hang Seng Index rose 3.1 percent, after falling the most since November 2008 on Wednesday.

Chinese inflation rose faster than economists forecast in June, suggesting a stabilization in demand that’s now threatened by the stock market’s rout. The Federal Reserve registered concern over China as early as last month, with meeting minutessignaling potential risks to the U.S. from there and Greece.

Japan’s Topix index slipped 1.2 percent, paring a decline of as much as 3.6 percent. South Korea’s Kospi index fell 0.6 percent. New Zealand’s NZX 50 Index slid 0.8 percent. Australia’s S&P/ASX 200 Index dropped 0.4 percent.

Greece is rushing to pull together a blueprint of reforms to convince European leaders headed by German Chancellor Angela Merkel that it can keep the euro. The government extended capital controls to Monday and Prime Minister Alexis Tsipras has until midnight Thursday to come up with an economic plan that will cut spending in exchange for a new European bailout.

E-mini futures on the Standard & Poor’s 500 Index rose 0.5 percent today. The underlying U.S. equity benchmark index sank 1.7 percent on Wednesday. [Ref]

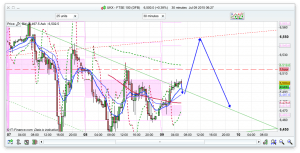

FTSE Outlook

All looks quite positive first thing this morning for a rise to 6550 where we have 3 key resistance levels – the top of both 10min and 30min channels, but also the top of the Bianca 10 day at 6553. As such I think a short at this area could be worth a go, after a long this morning. We have had an EMA cross not he 30min but not retested the 25ema as yet so I have plotted a little dip down to that though its 50/50 if that will happen. We have rebounded well from the overnight lows and the first bridge that the bulls will need to cross to keep this rise going is the 200ema on 30min at 6519 – may see a bit of a stutter there. That is also just above yesterday high. With Greece ongoing then the market might have a bit of a rise on the hope that some sort of resolution can be found, though this weekend is D-Day. The banks are closed again today there as well and Europe’s creditor powers have been warned against igniting an “uncontrolled” financial and geopolitical crisis in Greece by letting the country fall out of the eurozone at the end of the week. US Treasury Secretary Jacob Lew waded into the crisis, as Athens was preparing to make its final attempt to secure its future in the single currency. The Greeks have been told they have three days to prevent a fatal eurozone exit.

I’m with you there Nick, put my bear back in the cage for today, nice little dip to 500 for a good entry at the opening.

This morning has broken the 3hr downtrend from 24/6, first target now ~6570. Looking to buy a dip to 20 to hold for a while.

A bit overbought to get through high that time, DAX also knocking on 686 resistance.

Will look at adding on break of both.

*866 resistance

SHORT 10860, stop 10873, target 10785

Stopped…. 🙁

If you’d have turned it around on stop, instant money back 😉

Perfectly timed rumour to push dax through that resistance

I’m looking for a short around 950 for a return to 920.

Oh yeah, they play dirty alright.

Remind me to tell you the massive copper long and Chilean force majeure rumour sometime.

My finest work 🙂

Sounds interesting!!

Think thats possible? Got decent resistance at 6550 myself?

I think a break of 40 will get to your resistance quickly and probably fail temporarily, then it’s decision time whether it can kick on through or fade and drop.

Added at 39 on the way through stop on all at 25

So here we are at 50, overbought short term so taking half out at 52 looking to buy a pullback to ~40

Morning Chaps – Hope you’re enjoying the ride. Missed it myself will have to wait for the next opportunity.

Not trading it – but I’ve got a RSI trio on DAX 10920

FTSE RSI Trio 6550 (Sell)

6553 for the top of the 10 day channel too

Pack it in you guys, here I am bullish for once in a blue moon and you’re p*ssing on my chips lol

Could well be the top here, but where’s the selling?

Rising support line now at 44 will add around there and stop at 38, happy now?

Dow 110 – 130 Points higher than than last night’s close. Could possibly create some weakness.

Grasping at straws a bit there Hugh.

I’ve been thinking about that meltdown on the DOW, coincided nicely with huge Chinese margin calls.

Tmpf bullish 😉

Yeah amazing is it not Senu?

Added at 54, now quite a big long average 40 with a break even stop

Fiddly diddly – Stopped out flat.

Looking for an exhaustion burst towards 65/70 to dump some of this

Dumping started

and out tyvm

and a little rsi short for good measure 10 either way

out for 7 see if uptrend holds, if it doesn’t, thinking about a short on break of 56 for 12 either way

Short 66 for fail 8 either way

missed by .5 🙁 out for a couple

Odds on new high

Had a short 10923 when I left for dentist for 11. Expected some weakness, when I was back at 11.40 nearly managed to escape with little profit. I wish I was there when it was 10911. Never mind, up 30 points today (bits and pieces). Put several short orders starting 10951.

Looking strictly at 1 hour chart I think strong support is 10960-80 (S3 is also there 10965), theoretically it should pull back from there to at least 10812 or who knows. EMA and MACD strongly on buy at the moment and I would be cautious with shorts (personally) as the top is unknown. My orders are high, let’s see how they play out.

1st order triggered 10951

Where is your stop Jack ? I had a long this morning from 806 and came out at too early at 55 just before the spike and have been looking to short since doesn’t look like its going to reverse before 11069. I have no trade plan will wait for DOW open.

Got out of this ordeal with another 25 points. 51 was triggered so as 85 and 91 (at different time). In the end had to give away 51 loss for the upper win. In total 25 points profit on this one. Generally got a bit overcautious. Not much today, only 53 points. 150 points would be better of course.

I meant: I had to give a loss from 51 price, it was 21 points. But I won 45 points on other trades so in total it is 25 points profit on this “51 order” ordeal.

could have been worse.

I’m might look to go long if it gets to 950 very tricky to take a trade now doesn’t suit my risk/reward plan.

how’s is going with the dax shorts? I cant see the markets saying so high just before close

Getting heavily over bought medium term Short at 80, looking to add at 90 and 600

looks to me its hovering on the resistance, but I wouldn’t be surprised if it went up again, I was out at the 50 hover, kicking my self over the next 30 points

A classic bull morning chart, but that 5 hour long uptrend needs 72 to hold now and something like 85 by DOW opening, which will mean 150+ from yesterday’s close, quite a big ask.

I was tempted to buy back at 53, 70 and now 80. Each time I tell myself no, look for the short it just continues. I guess it will until the us opens. But there has to be a sell off this afternoon with jitters on whether tsipras produces anything or not as well as what china does tonight.

Changing that to 95 and 6010 for more shorts, stop 6625, this could run away a bit I think.

No Milka, there doesn’t “have to be a sell off” lol

did you get the 95 tmfp

yh well china shut its market so its fingers in ears lets have a run up until the evening.

Decided not to continue with shorts today, spent nearly all morning (including dental appointment), I need to get ready for a concert.

Personally I feel uncomfortable shorting when EMA pushed trough 200EMA like a train and sitting above, looks like trending. Too tricky to spot a short in such conditions. Maybe US open will bring a bit of more ramble to it, but I am out.

tmfp…i really like your transparent and honest contributions

Is there a good book you would recommend about rsi trading?

Thanks Darren, I try to be constructive.

A book about RSI? Yes, but I haven’t written it yet lol.

🙂

dont know if you remember me Nick?

Taking av of 17 on the shorts at 70 not sure how this is going to play out yet

Thats quite a good double hold at 63, tempted to short around 85 but I think downside is a bit limited

Trying it anyway

b/e stop now no heroics

That’s it for me, an excellent day, catch you in the morning

🙂

will dow close below your 600 today also? tmpf 🙂

It looks like Nick’s arrows are more suitable for Dow today. I think it overreacted a bit … killing people’s stops…

crazy after market tonight

fuming, sold a dax long today at 10966. was hoping to buy back lower this evening. It spiked at 12200 at 10.10pm and is now 11170.

dax currently gapped 250 odd points and ftse 70 odd points.

that’s what a market maker does for you (I nearly wrote money maker, but to be honest it is the same for them)

Think we’ll go to 6693 -7026.

Right click open in new tab.

http://s44.photobucket.com/albums/f25/FTSEDAYTRADER/?action=view¤t=display_chartimage_zpsf350a6de.png

wasn’t sure if that 7026 was a typo? Did you mean 6726?

It’s early …! Thank ZZ …yes typo 6726

Revised chart with typo corrected.

Right click open new tab…

http://s44.photobucket.com/albums/f25/FTSEDAYTRADER/Mobile%20Uploads/?action=view¤t=display_chartimage_zps5792f648.png

I know the feeling – mind you I wouldn’t be surprised if we do see 7026 as well if we keep on gapping up 100 points!

Long Dax before close…sweet!

closed it for +300 @ 11275

Great trade … !

lucky trade…but thx

brave man you are.