Good morning. Well that was slightly frustrating as it played out as per the arrows with the rise to 6575 and then fell away but it just missed the short order at 6577 for all those of us that just leave it to do its things. Annoying to have a 150 point rise and then miss the order by 2 points! Anyway, todays another day and never look back as they say. Apart from missing the order I gather lots of you got points on the way up and then on the way back down again as well.

Greece Latest

Greek Prime Minister Alexis Tsipras was given hours to come up with a plan to keep his country in the euro as citizens endure a second week of capital controls.

German Chancellor Angela Merkel said “time is running out” as she and French President Francois Hollande, leaders of the two biggest countries in the euro bloc, responded to Sunday’s referendum. The European Central Bank piled on the pressure by making it tougher for Greek banks to access emergency loans. Finance ministers and leaders from the 19-member region gather Tuesday.

After promising Greek voters a “no” outcome against austerity would strengthen his negotiating hand, the onus is on Tsipras to prove he can get a deal with creditors insistent on tax hikes and spending cuts as the price for a new bailout of Europe’s most indebted nation.

“The last offer that we made was a very generous one,” Merkel said Monday at the Elysee Palace in Paris. “On the other hand, Europe can only stand together, if each nation takes on its own responsibility.”

Heading into the Brussels talks — 1 p.m. for the finance chiefs, and 6 p.m. for the summit — Greece made a pre-emptive concession to its trio of creditors with the resignation of outspoken Finance Minister Yanis Varoufakis who clashed with his counterparts from other countries, especially Germany’s Wolfgang Schaeuble. [Ref]

US & Asia Overnight from Bloomberg

Asian stocks rose, with the regional benchmark index rebounding from the biggest drop since February 2014, as investors weighed developments in Greece’s debt crisis before an emergency meeting of European leaders.

The MSCI Asia Pacific Index gained 0.4 percent to 144.06 as of 9:02 a.m. in Tokyo after falling 2 percent on Monday. The initial shock waves that hit markets after Greece’s decision to call a referendum on austerity terms dissipated into a ripple by the end of Monday trading, as investors speculated the crisis wouldn’t spread beyond the nation’s borders. Greece is now under pressure to come up with a plan to stay in the euro after Greeks voted to reject further austerity in Sunday’s vote.

“With a muted reaction to the Greece situation from Europe overnight, I would expect a bounce in defensives today after having seen two very solid days of selling,” Evan Lucas, a markets strategist in Melbourne at IG Ltd., wrote in an e-mail to clients. “Clearly the market sees the risks from Greece as being ring-fenced and unlikely to create contagion.”

Euro-area leaders and finance ministers gather Tuesday for an emergency meeting after German Chancellor Angela Merkel said “time is running out” for Greece to come up with a plan to stay in the currency union. The European Central Bank maintained the level of Emergency Liquidity Assistance available to Greece, while tightening terms related to collateral. Greek banks remain shut through Wednesday.

Greek Prime Minister Alexis Tsipras replaced Finance Minister Yanis Varoufakis, who resigned Monday after more than five months of fruitless back-and-forth in negotiating with creditors. Tsipras is betting that a less confrontational face will help him bring German Chancellor Angela Merkel and other European leaders back to the table.

Regional Gauges

Japan’s Topix index climbed 1.2 percent. South Korea’s Kospi index gained 0.7 percent. Australia’s S&P/ASX 200 Index increased 0.3 percent, as did New Zealand’s NZX 50 Index. Markets in China and Hong Kong have yet to open.

FTSE China A50 futures rose 0.6 percent in most recent trading, after most Chinese stocks fell on Monday as a fresh round of government support measures failed to spark gains outside the largest state-run companies. More than two shares dropped for each that rose on the Shanghai Composite Index, which closed 2.4 percent higher. The ChiNext measure of smaller companies sank 4.3 percent, while the Shenzhen Composite Index retreated 2.7 percent.

China Steps

China suspended initial public offerings and brokerages pledged to buy shares in weekend measures aimed at halting the market rout. Mainland shares posted their biggest three-week slump since 1992 on concern leveraged traders are liquidating bets after valuations exceeded levels seen during China’s stock-market bubble of 2007.

Futures on Hong Kong’s Hang Seng Index climbed 0.5 percent in the most recent session. The measure sank the most since 2012 on Monday, bringing its decline from an April peak to 11 percent and meeting the common definition of a correction.

E-mini futures on the Standard & Poor’s 500 index added 0.1 percent today after the equity measure lost 0.4 percent on Monday. The Stoxx Europe 600 Index dropped 1.2 percent on Monday. [Ref]

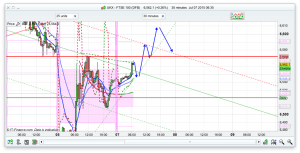

FTSE Outlook

As I write this at 06:25 there is resistance initially at the 200ema on the 30min chart, so I think we will see a slight dip from here. However the moving averages both 10min and 30min are bullish so I think we may well get a rise towards the top of the 10 day Bianca at 6608 today, a good level for a short if seen. We also have the top of the 10 day Raff at 6629 if it overshoots Bianca, and then the 25ema on daily at 6684. Generally, looking at the charts I feel pretty bullish for today though of course a lot will depend on the Greek situation throughout the day, and there are more talks later this afternoon.There is a decline PRT channel with resistance at 6586, which I think we will see some bearishness from if the bulls break the 200ema level at 6563. On the support side of things, we have the daily pivot at 6510, and the T3 trend line at 6526 just above that. If both of those break then the bottom of the 20 day Bianca channel at 6447 is worth a long. The bottom of the 10 day Bianca is a lot lower at 6381, don’t think we will see that unless Greece leaves the Eurozone and then there is a panic sell off. I think the rest of the Eurozone want to keep Greece in otherwise it sets off the domino effect with Spain, Italy, Portugal etc also looking to renegotiate and/or leave.